![[field_slider_background_image-alt]](https://indiana.bank/sites/iba/files/Emerging-Leaders-24-rotator-2.jpg)

Emerging Leaders - A Digital Program

Designed for key staff in the bank who are emerging as potential leaders

Learn more and register

![[field_slider_background_image-alt]](https://indiana.bank/sites/iba/files/Mega_2024_rotator.jpg)

![[field_slider_background_image-alt]](https://indiana.bank/sites/iba/files/Commercial-Lending-24-rotator.jpg)

Commercial Lending School | June 10-14

Preparing mid-level bankers and commercial loan officers to serve effectively and profitably

Learn more and register

![[field_slider_background_image-alt]](https://indiana.bank/sites/iba/files/BTHQ-rotator.jpg)

Emerging Leaders - A Digital Program

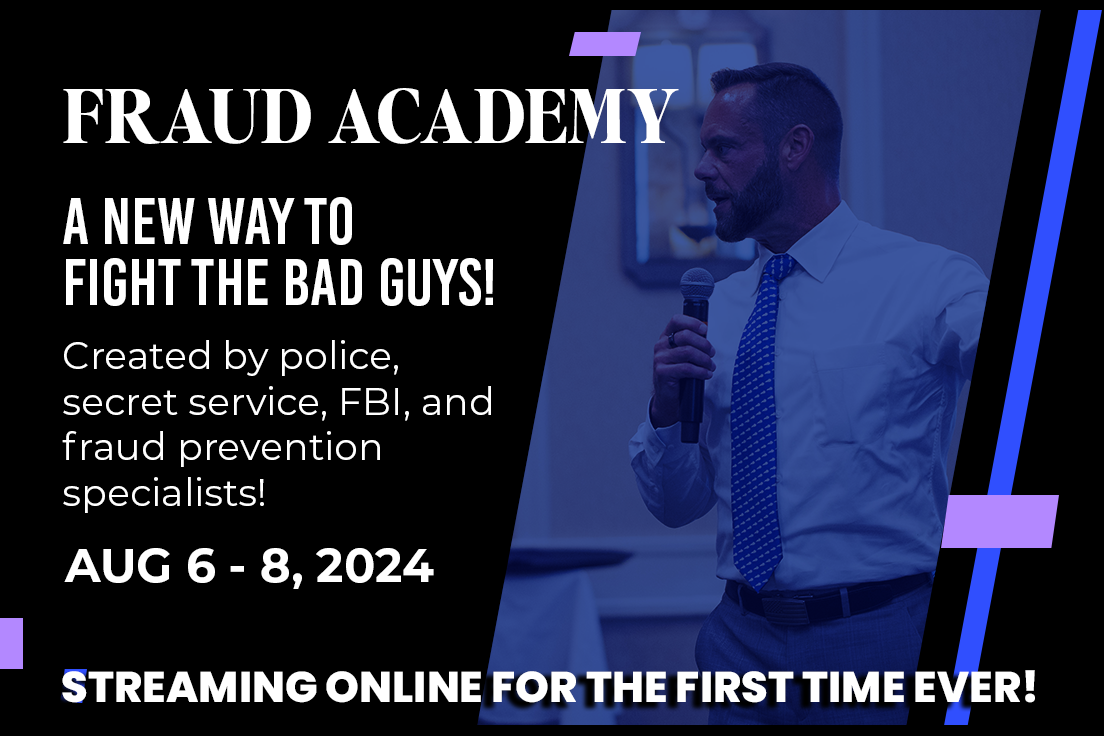

Mega Conference

Commercial Lending School

BankTalentHQ